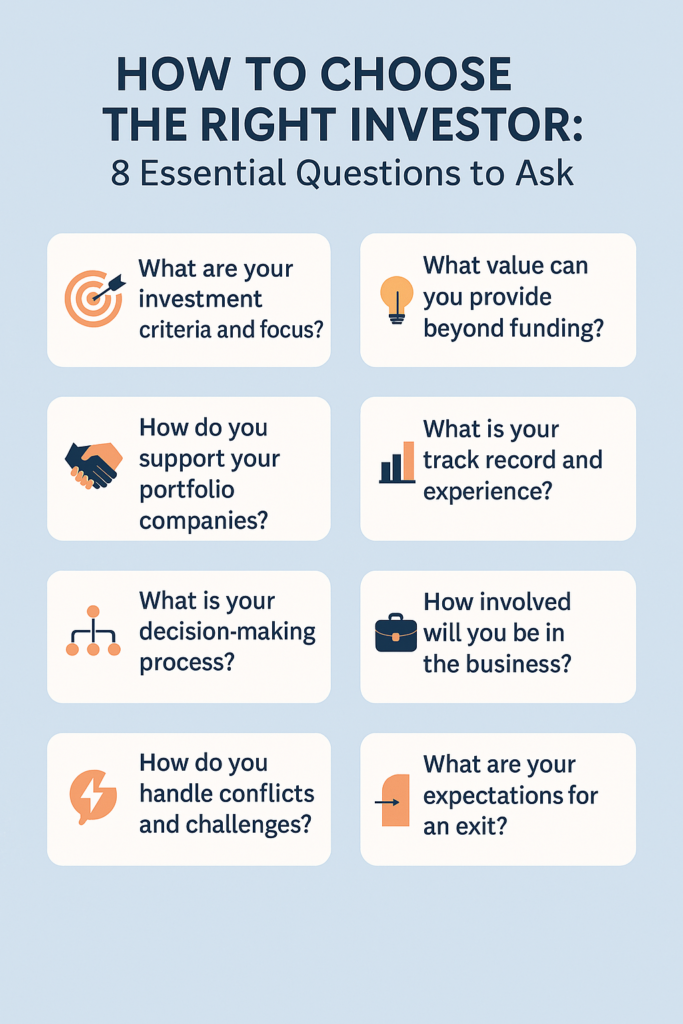

The trajectory of your business can be profoundly shaped by the investors you bring on board. Indeed, selecting the right investor is not merely about securing capital; it’s a pivotal decision that can significantly influence your company’s direction, pace of growth, and even its fundamental culture. Beyond the financial injection, the ideal investor brings a wealth of experience and resources that can propel your vision forward. This post will guide you through How to Choose the Right Investor by outlining 8 essential questions you must ask potential partners. These questions are not just a formality, but a proactive step in ensuring that your values and goals align seamlessly with your own business aspirations. Ultimately, finding the right investor can be the difference between achieving sustainable, long-term success and facing unforeseen challenges. Asking the right questions upfront is therefore not just advisable, but absolutely critical.

How to Choose the Right Investor: Why This Decision is Crucial for Your Business Success

Understanding the Role of an Investor

Investors play a multifaceted role in the lifecycle of a business. Primarily, they provide the necessary capital to fuel growth and expansion. However, their contribution extends far beyond just financial backing. Savvy investors also bring invaluable expertise gained from their experience across various ventures and industries. Furthermore, they often possess extensive networks of contacts that can open doors to new opportunities, partnerships, and talent. Finally, they can offer strategic guidance and resources that can help your business navigate complex challenges and achieve its full potential.

The Long-Term Relationship with Investors

The relationship with an investor is not a short-term transaction, but a long-term partnership that can last for many years, potentially spanning the entire growth journey of your company. This extended duration underscores the vital importance of ensuring compatibility from the outset. Just as you carefully select key hires for your team, choosing an investor requires a similar level of diligence and consideration. Integrating “How to Choose the Right Investor” into your due diligence process means asking the pertinent questions that will reveal whether a potential investor is the perfect fit for your business’s unique needs and long-term vision.

How to Choose the Right Investor: 8 Essential Questions to Ask Potential Investors

1. What Are Your Investment Criteria and What Types of Companies Do You Typically Invest In?

Purpose: Understanding an investor’s typical portfolio and their established investment criteria is fundamental to determining if there’s a genuine alignment with your business. Asking this question early on can save both you and the investor valuable time and effort.

What to Look For: Pay close attention to the investor’s answers regarding their preferred industry focus, the specific stage of companies they typically invest in (e.g., seed, Series A, growth stage), and the average amount of capital they typically deploy in a single investment. This information will help you gauge whether your company falls within their sweet spot. Reiterating “How to Choose the Right Investor” here emphasizes that asking these targeted questions is a key step in selecting the ideal investor.

2. What Value Do You Bring to the Table Beyond Funding?

Purpose: While capital is essential, truly valuable investors offer much more than just money. This question aims to uncover the additional resources and support they can provide to help your business thrive.

What to Look For: Listen intently for how the investor envisions their role in actively helping the business grow beyond simply providing capital. Do they offer mentorship based on their own entrepreneurial or industry experience? Can they provide valuable industry connections or introductions to potential partners or customers? Do they offer strategic guidance on key business decisions or operational support in specific areas?

3. What Is Your Track Record and Experience in This Industry?

Purpose: Investors who possess a proven track record and relevant experience within your specific industry are often better positioned to provide insightful guidance and understand the unique challenges and opportunities your business might face.

What to Look For: Discuss how their prior experience can directly benefit your company. Have they successfully helped other companies in your sector navigate similar problems or capitalize on emerging trends? Their industry-specific knowledge and network can be invaluable assets as you scale your business and navigate potentially difficult situations.

4. How Involved Are You in the Companies You Invest In?

Purpose: The level of involvement an investor prefers can vary significantly. Some adopt a hands-off approach, trusting the management team to execute their vision, while others prefer to take a more active role in key business decisions.

What to Look For: It’s crucial to understand whether the investor is likely to want a seat on your board of directors or actively participate in day-to-day decision-making. Consider your own preferences and the stage of your company to determine what level of involvement would be most beneficial for your business’s growth and autonomy.

5. What Is Your Approach to Handling Disagreements and Conflicts?

Purpose: Even in the most harmonious partnerships, disagreements and conflicts are inevitable. Understanding how a potential investor approaches conflict resolution is vital for maintaining a healthy and productive long-term relationship.

What to Look For: Look for answers that indicate a collaborative and constructive approach to conflict resolution. Do they prioritize open communication and finding mutually beneficial solutions? This is crucial for maintaining a healthy and productive long-term relationship. Avoid investors who seem overly rigid or unwilling to compromise, as this could lead to significant friction down the road.

6. What Are Your Expectations for Return on Investment (ROI)?

Purpose: Investors, by nature, are looking for a return on their investment. Understanding their expected ROI timeline and magnitude upfront is critical for aligning expectations and ensuring your business goals are compatible with their financial objectives.

What to Look For: Discuss how their expectations align with your business’s projected growth trajectory and overall financial goals. A significant mismatch in expectations could create undue pressure or lead to strategic decisions that are not in the best long-term interest of your company.

7. Can You Provide References or Examples from Other Companies in Your Portfolio?

Purpose: Hearing directly from other entrepreneurs who have worked with the investor can provide invaluable insights into their working style, supportiveness, and overall impact on their portfolio companies.

What to Look For: Ask for specific examples of portfolio companies they’ve actively worked with and how their support, guidance, or network helped lead to tangible success. Don’t hesitate to reach out to these references to gain a firsthand perspective on the investor’s involvement and effectiveness.

8. What Are the Key Milestones or Metrics You Focus on to Track Business Progress?

Purpose: Knowing which key milestones and metrics an investor considers most important for tracking your business’s progress helps ensure alignment in expectations and reporting.

What to Look For: Investors often focus on metrics such as revenue growth, market share gains, customer acquisition cost (CAC), customer lifetime value (CLTV), and other key performance indicators (KPIs). Make sure these align with your own understanding of your business’s critical success factors and that you are comfortable reporting on these metrics regularly.

How to Assess Investor Compatibility

Aligning Business Values and Goals

Key Consideration: Beyond the financial and strategic aspects, it’s crucial that potential investors share similar core values and a congruent vision for the future direction of your business.

How to Evaluate Compatibility: Discuss your company’s mission, long-term strategic goals, and even ethical considerations. Evaluate whether the investor’s values and perspectives align with your own. A fundamental misalignment in these areas can lead to significant challenges and conflicts as your business evolves.

The Importance of Clear Communication

Key Consideration: Clear, transparent, and open communication is the bedrock of a healthy and productive relationship with any investor.

How to Evaluate Communication Style: During your initial discussions, actively assess how easy and comfortable it is to communicate with the investor. Are they responsive to your questions? Do they articulate their thoughts and perspectives clearly? A smooth and effective communication style early on is a strong indicator of a positive working relationship in the future.

Red Flags to Watch Out for When Choosing an Investor

Too Controlling or Hands-Off

Description: Both extremes in investor involvement can be detrimental to your business. Overly controlling investors can stifle innovation and micromanage operations, while completely detached investors may not provide the necessary support and guidance when you need it most.

What to Look For: Be wary of investors who exhibit signs of wanting to dictate every decision or, conversely, those who seem completely indifferent to the day-to-day operations and strategic direction of your company.

Misalignment in Business Goals and Growth Strategy

Description: If a potential investor’s expectations for business growth, exit strategy, or overall vision for the company don’t align with your own, it could lead to significant friction and disagreements down the road.

What to Look For: Pay attention to any warning signs that indicate fundamental differences in your expected pace of business growth, desired exit timeline, or overall strategic direction for the company.

Unclear or Vague Terms

Description: Exercise caution when dealing with investors who provide unclear, overly complex, or potentially unfavorable terms for their investment.

What to Look For: Focus on straightforward, transparent, and easily understandable investment terms. Don’t hesitate to seek legal counsel to review any investment agreements and ensure you fully comprehend all the implications before committing.

How to Build a Strong Relationship with Your Investor

Setting Expectations Early

Description: From the very outset of your partnership, ensure that both you and your investor have clearly defined and mutually agreed-upon expectations regarding all aspects of your working relationship.

What to Focus On: Discuss and establish clear expectations around communication frequency and channels, the level of investor involvement in decision-making, key performance milestones and reporting timelines, and any other relevant aspects of your collaboration.

Regular Updates and Transparent Communication

Description: Maintain a consistent and proactive communication schedule to keep your investors well-informed about your company’s progress, any challenges you are facing, and all major decisions being made.

Best Practices: Establish regular check-in meetings (whether in person or virtual), provide timely updates on key milestones achieved and challenges encountered, and maintain open and transparent communication channels for addressing any questions or concerns that may arise.

Leveraging Their Expertise and Network

Description: One of the significant benefits of having the right investor is the ability to tap into their valuable experience and extensive network of contacts.

Best Practices: Don’t hesitate to actively leverage your investor’s connections to help grow your business, whether it’s seeking introductions to potential customers, partners, or even talent. Their expertise can also be invaluable in navigating specific challenges or making strategic decisions.

Making the Right Choice for Your Business’s Future

In summary, the decision of who you bring on as an investor is one of the most critical choices you will make for your business. The right investor can provide not only crucial capital but also invaluable guidance, expertise, and connections. Remember that How to Choose the Right Investor involves a thorough and thoughtful process, and asking the right questions is paramount to ensuring a successful partnership. Ultimately, finding an investor whose goals, values, and vision align with your own is crucial for long-term success and creating a thriving and sustainable business. We encourage you to begin your search for the ideal investor by carefully considering these 8 essential questions and preparing thoroughly to assess each potential partner.

Ready to choose the right investor for your business? Don’t leave this crucial decision to chance—use these 8 essential questions to find the perfect partner who aligns with your goals and values. Start asking the right questions today to set your business up for long-term success. Get started now at ProfilePitch.com and take control of your growth journey!